Hire UI UX Designer to Transform Your Brand Across Every Digital Channel

There was a time when one great product or one reliable client could carry a business. That era is gone. In the digital age, markets move faster, customer expectations shift overnight, and technology can make or break entire categories. Relying on a single source of income is not a focus; it is fragile. Serious leaders now treat revenue diversification as core risk management, not a nice-to-have.

If you already invest in small business IT solutions, you are halfway there. Technology gives you options, but a resilient model gives you staying power. This article lays out why single-stream dependency is dangerous, how to start diversifying revenue streams, and how to use technology and operating discipline to turn digital risk into a competitive advantage.

As a small business leader, you do not need more buzzwords. You need a practical way to design revenue resilience that fits your people, your process, and your platform. That is the heart of managing the risks of digital transformation.

Two realities define today’s market. Speed and uncertainty. Platforms change rules, algorithms shift reach, supply chains flex, regulations tighten, and new interfaces and new expectations shape buyer behavior. A single revenue stream creates a single point of failure in this environment.

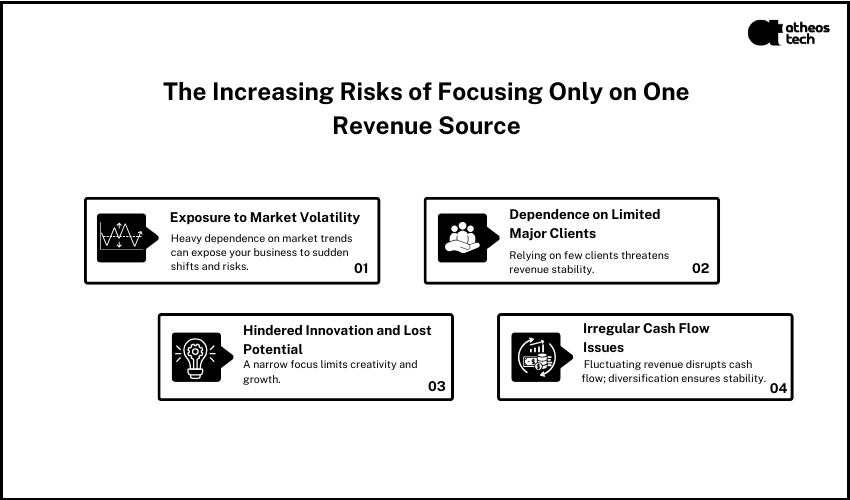

Consider the main pressure points:

A modern revenue strategy accepts volatility as a constant and reduces exposure by design. This is classic risk management applied to growth.

A single stream forces your model to carry all risk vectors at once. If demand dips, you have no counterweight. If acquisition costs rise, you have no offset. If a partner changes terms, you have no alternative route to value. Even if the stream is working today, it produces a concentration risk that compounds over time.

Diversification is not doing everything. It is analyzing revenue models and adding two or three complementary sources of value that fit your capabilities and your customers. The goal is correlation control. When one stream slows, another stabilizes cash, and a third funds forward bets.

Relying on a single source of income exposes a business to a cascade of interconnected risks that can threaten its very existence.

A resilient portfolio blends several dimensions:

This is not a theory. It is a practical blueprint for small business IT solutions that reduce earnings volatility and improve valuation.

Ken runs a boutique B2B services firm. For six years, eighty percent of revenue came from one flagship retainer. It felt efficient until the client brought work in-house. Revenue fell by half in sixty days.

Ken paused the firefighting and worked with a strategist to redesign for resilience. He bundled his core expertise into three offers that shared the same knowledge base and the same delivery spine.

He used his existing small business IT solutions stack to sell, deliver, and support these offers. A lightweight CRM and billing system handled subscriptions. A content platform delivered toolkits. A simple partner portal tracked referrals and payouts. In nine months, Ken was no longer dependent on a single client. Total revenue surpassed his old peak, and his margin improved because digital delivery scaled without proportional headcount.

Ken did not chase every idea. He chose three streams that shared content, data, and workflows, so he could operate lean and still grow. That is managing the risks of digital transformation in action.

Technology should make diversification simpler, not heavier. The right small business IT solutions give you scale without complexity. The wrong tools create overhead and distract from revenue work. Anchor your stack to these layers:

If you already operate on a tech backbone, you can extend it into new monetization with minimal lift. If not, start small and choose Simple first. You can always add advanced functions when adoption is high.

For a deeper playbook on building out revenue lines, see our companion guide, Already Digital? It’s Time to Build Multiple Revenue Streams.

Use a structured filter rather than instinct.

Then run a test plan. Pre-sell to validate demand. Pilot with ten customers. Measure adoption and satisfaction. Only then invest in scale.

CFO quality visibility is now a requirement for owners. Track at least these metrics per stream:

Tie these numbers to dashboards built on your small business it solutions so teams can act, not just report. This is where consulting services for small businesses often deliver quick wins by instrumenting the pipeline and exposing bottlenecks.

Map your next two revenue streams strategy session with AtheosTech.

A seasoned small business consultant will help you avoid these traps by aligning offers, processes, and systems before scale.

Many firms over-rely on one inbound channel or one payment provider. This is still a single-stream problem. Build redundancy.

This is channel-level Risk Management that protects

your revenue base.

When you run two or three streams, you need clarity in how work moves.

These patterns reduce unit cost and keep complexity in check as you add revenue options.

Turn your tech stack into a revenue engine. Book a Digital Resilience Audit with AtheosTech.

There is a difference between buying tools and building systems. Small business consulting firms guide you to the latter. Advisory accelerates three outcomes:

If you want structured help, Small Business Consulting Services can be the catalyst that turns intent into cash flow. Leaders often engage a partner to design the roadmap, choose the small business IT solutions, and coach teams through adoption. Firms like AtheosTech operate as an extension of your team, so you move faster with less waste.

Digital work carries its own risks. Scope creep, low adoption, fragmented data, and security gaps can erode gains. Treat transformation as a continuous risk management program.

With a strong operating rhythm, you will turn digital risk into competitive advantage rather than an expense.

Your next stream should not be a guess. It should be a design decision. AtheosTech helps founders and operators blueprint, validate, and scale new income lines with an execution first mindset. We bring the strategy patterns and the delivery muscle to align offers, operations, and the right small business IT solutions. Whether you need a commerce layer for subscriptions, a portal for digital delivery, or analytics for pricing and churn, AtheosTech builds systems that pay for themselves.

When you are ready to productize services or turn expertise into recurring revenue, AtheosTech supplies the patterns, the tooling, and the playbooks that move you from single stream risk to multi stream durability. For sustained momentum across the next year, leaders partner with AtheosTech to create a focused roadmap and ship on a monthly cadence.

Your next stream should not be a guess. It should be a design decision. AtheosTech helps founders and operators blueprint, validate, and scale new income lines with an execution first mindset. We bring the strategy patterns and the delivery muscle to align offers, operations, and the right small business IT solutions. Whether you need a commerce layer for subscriptions, a portal for digital delivery, or analytics for pricing and churn, AtheosTech builds systems that pay for themselves.

When you are ready to productize services or turn expertise into recurring revenue, AtheosTech supplies the patterns, the tooling, and the playbooks that move you from single stream risk to multi stream durability. For sustained momentum across the next year, leaders partner with AtheosTech to create a focused roadmap and ship on a monthly cadence.

One revenue stream is a liability in the digital age. A resilient firm uses selective diversification, disciplined measurement, and the right small business IT solutions to control its exposure and compound its gains. Use the principles in this guide to identify, validate, and scale two or three streams that fit your customers and your operating backbone. If you want a step-by-step companion on building those lines, read Already Digital? It’s time to build multiple revenue streams and use it as your internal playbook.

If you seek a strategic partner rather than a software vendor, AtheosTech stands ready to help you map, build, and measure multi-stream growth. Advisory plus engineering, all aligned to outcomes. That is how small businesses grow on purpose.

Adding {{itemName}} to cart

Added {{itemName}} to cart